Mortgage Broker San Francisco: Your Key to Securing the Best Home Loan Rates

Mortgage Broker San Francisco: Your Key to Securing the Best Home Loan Rates

Blog Article

Exactly How a Home Loan Broker Can Assist You in Navigating the Mortgage Process

Browsing the intricacies of the home funding process can be discouraging for numerous potential purchasers. A mortgage broker offers as an essential resource, leveraging their proficiency to evaluate your economic scenario, connect you with numerous lending institutions, and streamline the application process.

Understanding the Function of a Home Loan Broker

A home loan broker acts as a crucial intermediary in between borrowers and loan providers, assisting in the lending process for people looking for funding to acquire or re-finance a home - mortgage broker san Francisco. They have substantial knowledge of the home mortgage market and have accessibility to a wide selection of financing products from various loan provider. This allows them to identify one of the most ideal choices customized to a customer's unique financial situations

Home mortgage brokers streamline the application procedure by collecting required documents, analyzing creditworthiness, and sending applications on part of the borrower. They function as advocates, discussing terms and conditions to safeguard favorable rates of interest and financing terms. Additionally, they help customers browse the intricacies of home loan lingo and lawful demands, making sure that customers fully comprehend their alternatives before making a dedication.

Analyzing Your Financial Situation

Before starting the mortgage trip, a complete analysis of your economic situation is important. This assessment acts as the foundation for comprehending your loaning capability and determining suitable finance alternatives. Begin by assessing your revenue resources, consisting of wage, bonuses, and any added incomes, to develop a clear photo of your monetary stability.

Next, examine your expenses, including regular monthly obligations such as rental fee, energies, and debt repayments. This will help identify your disposable revenue, which is necessary for evaluating just how much you can allocate in the direction of a home loan payment. Additionally, it is essential to examine your credit history score, as this will substantially affect your car loan eligibility and rate of interest. A higher credit history usually enables much more beneficial loaning terms.

In addition, analyze your financial savings to determine the amount available for a deposit and linked closing prices. A solid economic pillow not just enhances your loaning capability but likewise provides safety throughout the home getting process. By performing this extensive analysis, you will certainly get useful insights that empower you to navigate the home loan landscape with self-confidence, guaranteeing a well-informed decision when engaging with a mortgage broker.

Accessing a Wide Array of Lenders

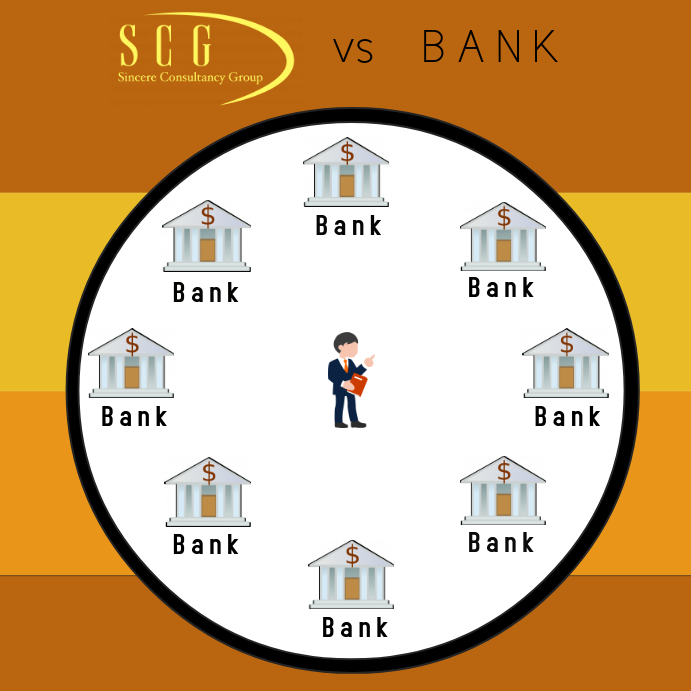

Accessing a variety of lenders is among the essential advantages of collaborating with a home loan broker. Unlike specific customers that may be restricted to their financial institution's offerings, home mortgage brokers have actually established relationships with a diverse variety of lenders, including banks, lending institution, and personal loan providers. This broad accessibility enables brokers to resource a variety of financing items tailored to various economic situations and borrower requirements.

A home mortgage broker can offer alternatives from numerous loan providers, each with special terms, rate of interest, and problems. This competitive landscape not just encourages borrowers to find the most desirable home mortgage terms yet also motivates lenders to offer extra attractive prices to secure company. Brokers can identify particular niche loan providers that might specialize in details funding kinds, such as those for first-time property buyers or people with less-than-perfect credit history.

Simplifying the Application Process

Navigating the home mortgage application procedure can typically really feel frustrating for many debtors, however a home loan broker plays an important role in streamlining this experience. They function as a bridge in between the financing and the consumer institutions, directing clients via each action of the application.

A home loan broker starts by evaluating the economic scenario of the debtor, assisting to gather essential paperwork such as revenue verification, credit scores our website reports, and work background. By arranging these documents and ensuring they satisfy loan provider needs, brokers conserve customers considerable time and stress and anxiety. This prep work is important, as incomplete or unreliable applications can cause delays or straight-out denials.

This aggressive technique not only streamlines the application but likewise enhances the total effectiveness of safeguarding a mortgage. Ultimately, a home mortgage broker's expertise and support can transform a daunting procedure right into an extra simple and convenient experience for possible house owners.

Working Out Better Terms and Rates

A mortgage broker acts as an effective supporter for consumers when it concerns discussing far better terms and rates on their mortgage. With considerable knowledge of the lending landscape, brokers leverage their partnerships with various loan providers to aid clients secure desirable problems that align with their monetary objectives.

Among the crucial advantages of collaborating with a mortgage broker is their capacity to access several loan items and rate of interest prices. This accessibility allows brokers to contrast offers and determine the most competitive choices readily available to their clients. They utilize strategic Full Report arrangement techniques, often causing lower rate of interest prices and decreased charges, which can result in considerable cost savings over the life of the funding.

In addition, a home loan broker can analyze a customer's one-of-a-kind monetary situation and suggest tailored options that reflect their demands. This individualized strategy enables brokers to promote efficiently in behalf of their customers, making sure that they receive the best possible terms.

Inevitably, partnering with a home mortgage broker can significantly enhance a customer's capability to secure advantageous home mortgage terms, facilitating a smoother and a lot more cost-efficient home financing experience.

Conclusion

A mortgage broker serves as an essential intermediary in between borrowers and loan providers, assisting in the lending process for individuals looking for click funding to refinance a home or acquire.Mortgage brokers streamline the application process by gathering needed documentation, assessing credit reliability, and submitting applications on behalf of the consumer. By conducting this detailed assessment, you will certainly get valuable insights that empower you to browse the home loan landscape with self-confidence, ensuring a well-informed decision when involving with a home mortgage broker.

One of the crucial advantages of functioning with a home mortgage broker is their ability to accessibility several car loan items and passion prices.In final thought, the know-how of a home mortgage broker plays a crucial role in navigating the intricacies of the home finance process.

Report this page